Refinansiering: Variable versus Fixed Mortgage

According to recent reports, mortgage rates were more or less 4% for a thirty-year fixed, 3% for a fifteen-year fixed, and 4.5% for the first five years on a 5/1 ARM or Adjustable-Rate Mortgage. The first step when it comes to deciding whether an ARM or a fixed-rate mortgage is the perfect choice for you in today’s market is to talk to some lending firms or professionals to find out what rate you qualify for, as well as what terms make a lot of sense for you with your credit score, debts, income, monthly payment, and down payment they can afford.

Once people know what term and rate lending firms will extend to them, how do they choose between fixed-rate mortgages and ARMs? People need to consider various factors.

ARM versus fixed: Difference when it comes to the monthly payment

When it comes to monthly payments, ARMs seem like a better choice between the two. It is the cheapest option per month. The larger people’s mortgage, the bigger their monthly savings. If they are borrowing $500,000, they will save at least $70 per month with adjustable rates. Is the difference significant enough to take on more risks associated with an adjustable-rate mortgage?

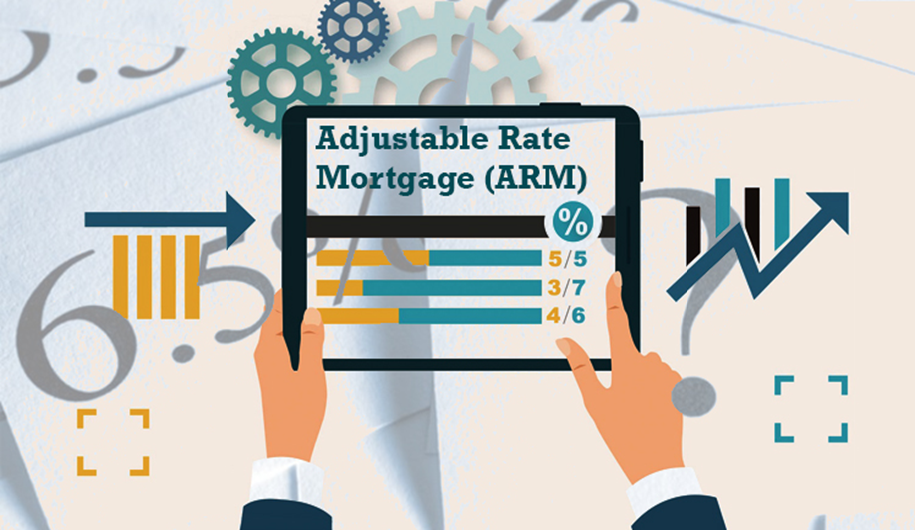

Types of ARM

Adjustable-rate mortgages come in various types. The most popular is the hybrid ARM, and out of these, the 5/1 ARM is the most popular option, followed by the 3/1 ARM, 7/1 ARM, and the 10/1 ARM. Here is how hybrid adjustable-rate mortgages work:

For instance, a 5/1 ARM has a fixed IR for the first five years, also called the introductory period. After the first five years, the IR adjusts every year for the rest of the long-term (let us say 30 more years). There are adjustable-rate mortgages that adjust less than once a year, like the 5/5 and 3/3 ARM, but these can be pretty hard to come by.

The longer the period, the smaller the difference will be between the rate of the adjustable-rate mortgage and the rate of the fixed rate. In the United States, the IR for most adjustable mortgages is based on the United States Treasury rate. Currently, the treasury rate is pretty low, so if individuals take out a flexible mortgage now, there is a good chance their IR will increase when the credit’s introductory period concludes.

Future plans and risk tolerance

When individuals take out FRM, they know before they sign their closing papers how much their payment will be each month for as long as they have the loan. A lot of individuals value this kind of stability. These kinds of refinansiering are subject to IR risks or the possibility of change in IRs.

After the primary term, the IR for this kind of loan adjusts to reflect the current market condition. How do people know what the loan’s IR will be when it resets after the primary period? Details about certain loans – what is called the IR cap structure – will tell people how high their monthly premium could go.

A 5/1 loan, for instance, might have a cap structure of 2-2-6. It means that in six years after the first five years expire, the IR can increase by two percent, in the following years, the IR can increase by 2% per year, and the total IR increase can never total more than six percent over the life of the credit. If the introductory charge was four percent for the first five years, the IR would be four percent.

After six years, it might increase by at least two percent depending on the one-year rate so that the charge could go as high as six percent. In the seventh year, the percentage could increase by two percent, making their rate of ten percent.

At this point, individuals would have reached the sixth ceilings; their portion would never go high more than ten percent. While caps minimize the person’s risk, on a $200,000 thirty-year loan, the difference between four percent and ten percent charge is a monthly payment of at least $900 versus at least $1,000.

Individuals have to ask themselves if the worst-case scenario of an additional $800 to $900 a month for the eighth year through the thirtieth is something they can live with. Whether people’s charges ever adjust that high will depend on the ARM’s index charges.

If it is indexed to the first-year percentage, and that percentage is not the same in the sixth year as it was in the first year, their IR will not increase in the sixth year. But if the treasury percentage has to hone up by three percent, their IR will not increase by more than two percent in the six because of caps.

Choosing between FRL and ARM

Now that borrowers know how ARMs compare to fixed-rate loan, how do they decide which one makes the most purpose for their case? According to experts, most of the borrowers fall into the fixed-rate bracket. They are usually first-time property owners purchasing single-family houses or condominiums and do not know what is next for them.

If borrowers end up having kids and need to stay in the house for good, a fixed percentage will provide stability and certainty in their payments. Since the interest has nowhere to go but up, a lot of property owners are not interested in taking the risk on ARMs.

Because of the current low rate environment, a lot of homeowners have been utilizing the thirty-year fixed credit option most of the time over the past six years for first-time purchasers. But it is imperative to have a talk about the person’s long-term goal and plans for the house.

In most cases, individuals do not know or cannot predict what their plans will be. Customers usually insist that it is just a starter house and they will not be living in it for more than five years. Based on experience, three to five years can actually be as short as one to two years if there is a job transfer, divorce, kids, or marriage, but this time frame can also extend to ten-plus years.

Individuals who think they will be in the property for a shorter time and want to use this plan could mitigate the risk by putting their monthly savings in an interest-bearing account to help cover a possible higher future premium if they are still in the house when the charges adjust. In reality, property buyers usually will not save this money, according to financial experts.

People with money, as well as investors who have plans for how long they will sustain the loan and can afford higher premiums later on, can see the appeal of this plan and benefit from the preliminary charges. If borrowers can afford a higher premium on a fifteen-year fixed charge and plan to stay in the property for a long time, it will save them the most money long term since the total premiums will be a lot lower. Locking in today’s low fifteen-year charges will undoubtedly be less costly compared to carrying this plan long term, even though it is a lot cheaper now.

In conclusion

Fewer than ten percent of individuals were choosing this kind of plan, according to the experts. If people want to use it because it has a much lower IR and can help them qualify for financing to buy more expensive houses, they need to consider whether the difference in the quality of the house they can get with it makes the risk worthwhile.

Borrowers are going to be tempted to purchase the house because it has good schools nearby, the property has new hardwood floors, or it is a peaceful neighborhood. However, people need to envision how they would feel about it and whether or not they could still afford it. For a lot of buyers in this kind of market, fixed charges are more prudent.