Direct mutual fund: Meaning, benefits, disadvantages,and how it works

Certain costs are associated with managing mutual funds, which are assessed as a proportion of your investments. The costs associated with mutual funds often include management and operational costs, including audit fees, registrar and transfer agent fees, marketing fees, custodian fees, and distributor fees. The exact amount of fees depends on a couple of things, one of them being the type of mutual fund you pick. In this context, there are two types of mutual funds: direct and regular.

What is a direct mutual fund?

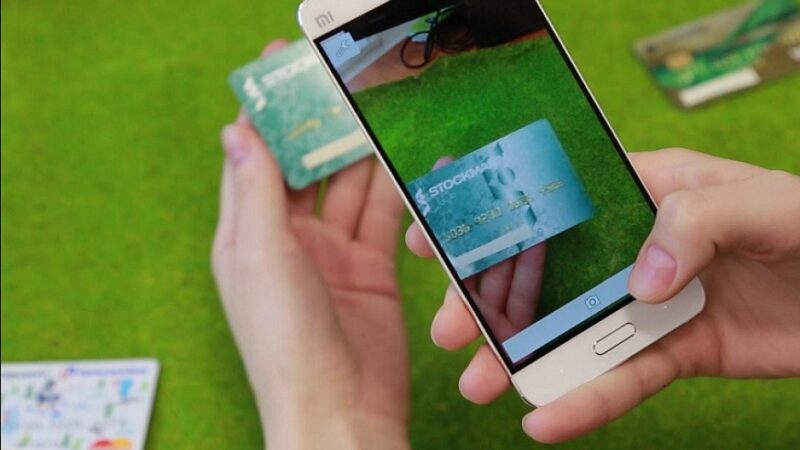

Direct plans are purchased directly from the Asset Management Company (AMC) or the mutual fund house offering the mutual fund scheme. When you directly invest in a mutual fund scheme from the AMC, no commissions or brokerage fees are associated because no third party is engaged in the transaction. As a result, direct plans’ expense ratio is lower than traditional or regular plans. You can invest in direct plans online by visiting the AMC’s website or the nearest branch of the AMC.

Benefits of direct mutual funds

-

Lower expense ratio

The expense ratio is the amount the AMC charges to manage the fund. When compared to traditional mutual funds, direct mutual funds have a lower expense ratio as the AMC doesn’t need to pay commissions to agents like in the case of regular mutual funds.

-

Higher returns

Since direct funds have a lower expense ratio than regular funds because no brokerage or commission is involved, the returns over the long term can turn out to be higher when compared to regular funds.

-

Higher NAV

A mutual fund’s Net Asset Value (NAV) is the market price of each unit of all the securities the fund owns. The assets include cash, treasury bills, bonds, equity shares, and other debt instruments. Since there is no distribution commission, the NAV of direct mutual funds would be higher than that of traditional mutual funds.

Disadvantages of direct mutual funds

-

Difficulty in selecting schemes

In India, several AMCs provide a variety of mutual fund plans. Choosing one scheme out of all the appropriate schemes by yourself can be difficult. In the case of regular mutual funds, the agent tends to offer advice on what kind of fund would be suitable for you based on your financial profile. This is missing when it comes to investing in direct funds.

-

Particular biases

Biases, such as investing in a fund solely based on a recommendation by a friend or colleague, can affect your investment portfolio. Biased investment decisions can impact long-term returns, and you may end up with negative or lower returns. As a result, people frequently need to pay more attention to the mutual fund scheme’s workings.

Who should invest in direct mutual funds?

Direct plans are a good option if you prefer to work directly with the AMC rather than deal with intermediaries. Direct funds are also suitable for you if you have the time and expertise to research mutual funds independently.

You will have to handle everything from the application process, including tracking, documentation, portfolio review, compliance issues, etc. If you feel confident to do that by yourself and wish to boost returns by lowering the expense ratio, you can consider investing in direct funds.