What Makes Money Transfer Online the Best Way to Remit to India?

Online remittance has become the go-to fund transfer option for most NRIs across the world. But what makes digital transfers so popular? Read this post to find out.

As compared to all the countries in the world, India is the largest remittance recipient. Millions of Indians working across the globe send billions of dollars back home every year. While offline transfers were popular in the past, most NRIs have now switched to digital transfers.

If you have recently moved to a foreign country, should you also consider online remittance? Take a look at five reasons that say you should-

1. Fast and Convenient

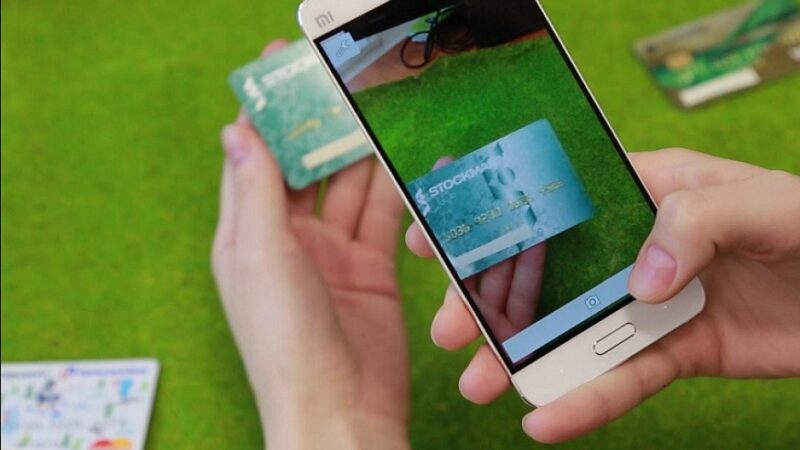

With online transfers, you no longer need to visit an offline transfer agent. You can easily initiate a transfer from your computer or even your mobile phone no matter if you are at home or office. If you know the steps, it should not take more than a few minutes to complete the transfer.

This helps in saving a lot of time and effort, making online transfers a better alternative to transfers through offline agents.

2. Better Exchange Rates

Some of the top Indian banks are known to offer highly competitive exchange rates to NRIs wanting to send funds to India. Apart from their extensive banking network in India, such banks have partnerships with international financial institutions, enabling them to offer better rates to the customers.

In other words, online transfers can help you get better value for your money. Some of the banks also offer additional features such as 24×7 guaranteed rates and rate block for enhanced convenience.

3. Faster Transfers

Digital transfers are also faster than offline remittance. If you are using the online services of an Indian bank in which you, as well as your recipient, have an account, the transfer can be instantly processed from many countries like the USA, UK, Singapore, Australia, Canada, and more.

Even if the recipient does not have an account in the same bank, the transfer can still be processed within 24 hours. In case of a financial emergency, the faster transfer speed of online remittance can come in very handy.

4. Track Transfers Online

With a lot of offline transfer services, your recipient in India is required to visit the nearest branch of the money transfer agent to collect the remittance amount. This can be risky and time-consuming for your recipients. But with money transfer online, the funds are deposited directly into the bank account of the recipient.

5. Direct Bank Deposits

With a lot of offline transfer services, your recipient in India is required to visit the nearest branch of the money transfer agent to collect the remittance amount. This can be risky and time-consuming for your recipients.

But with money transfer online, the funds are deposited directly into the bank account of the recipient. So, digital transfers are not only convenient for you but for your recipients as well.

Using Online Remittance to Send Money to India

As can be seen above, there are several reasons that make online remittance the best way to send funds to your recipients in India.

All you need is a reputed Indian bank that offers highly competitive exchange rates so that you as well as your recipients can experience the convenience, cost-efficiency, and safety of digital transfers